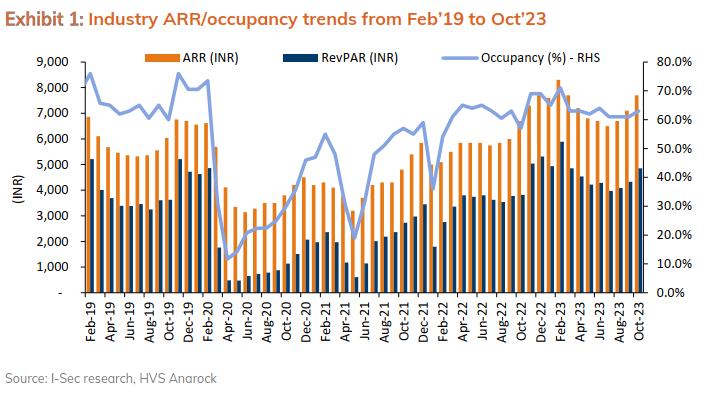

An HVS Anarock report highlights that Oct’23 was a stellar month for the hotel industry; the report notes industry RevPAR of INR 4,852was 27% above Oct’22 levels with ARRs being 15-17% higher YoY while occupancies were also up by 600bps YoY at 62-64%.

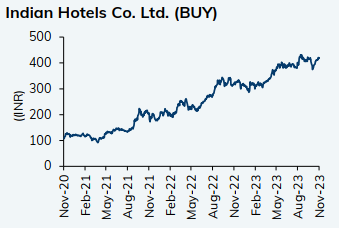

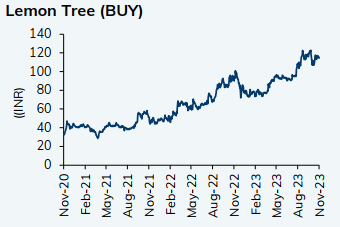

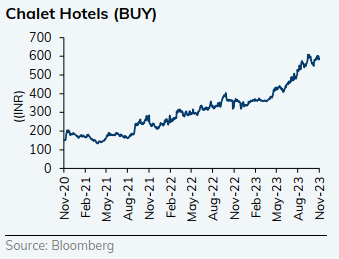

Along expected lines, demand was bolstered by the Men’s cricket ODI World Cup, particularly in cities hosting matches with ARRs growing between 15-33% YoY in those cities. Going forward, for the remainder of FY24E (Nov’23-Mar’24), the focus will now be on-demand drivers such as the wedding season, MICE and international tourist arrivals recovering to pre-Covid levels. The report channel checks for forward hotel rates for the Nov’23-Jan’24 period indicating that quoted rates are at least 10 higher than the previous year. Reiterate BUY ratings on Indian Hotels, Lemon Tree Hotels and Chalet Hotels.

Men’s cricket World Cup bolsters demand, sustainability remains key

The report channel checks for forward hotel room rates for Nov’23-Jan’24 compared to the Nov’22-Jan’23 period (previous year) indicating that hotels continue to follow a strategy of keeping rates at least 10% higher than previous year levels. While the Men’s cricket ODI World Cup boosted demand across cities in Oct’23, for the remainder of FY24E, demand drivers such as the wedding season, MICE and international tourist arrivals recovering to pre-Covid levels are expected to keep YoY RevPAR growth between 15-20%.

Expect double-digit industry RevPAR CAG Rover CY22-CY25

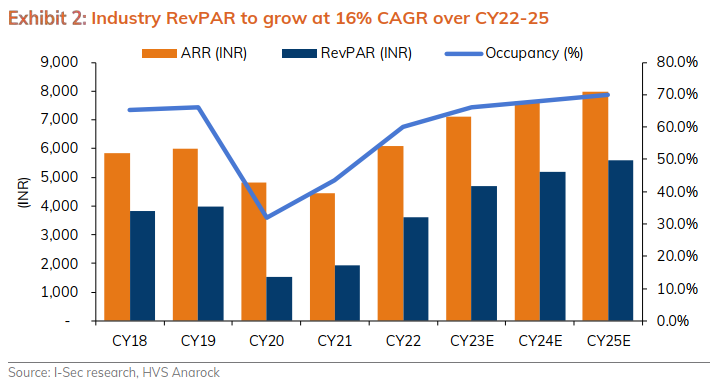

According to the India Hospitality Industry Overview 2022 by HVS Anarock, industry-level occupancies, which recovered to 60% in CY22, are estimated to reach 66% in CY23, 68% in CY24 and 70% in CY25. At the same time, industry ARR which stood at INR6, 100 in CY22 is estimated to reach INR7, 106 in CY23, INR7, 639 in CY24 and INR7, 983 in CY25.

In RevPAR terms, this implies that compared to CY22 industry RevPAR of INR3,600, RevPAR may rise to INR4,690 in CY23, INR5,194 in CY24 and INR5,588 in CY25 or a 15.8% CAGR in industry RevPAR over CY22-25. According to various industry estimates, with incremental room supply CAGR expected to range between 5-6% over CY22-26, medium-term demand supply dynamics remain healthy for the Indian hotel sector.

Brand signings pick up in CY22, management contracts rule the roost

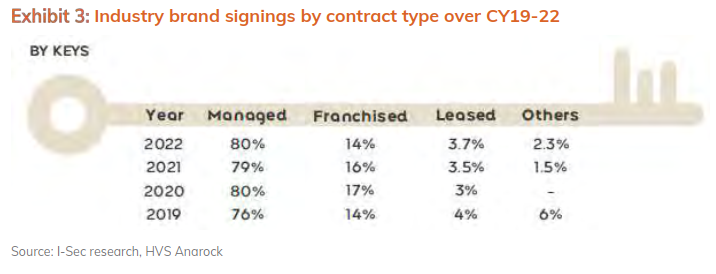

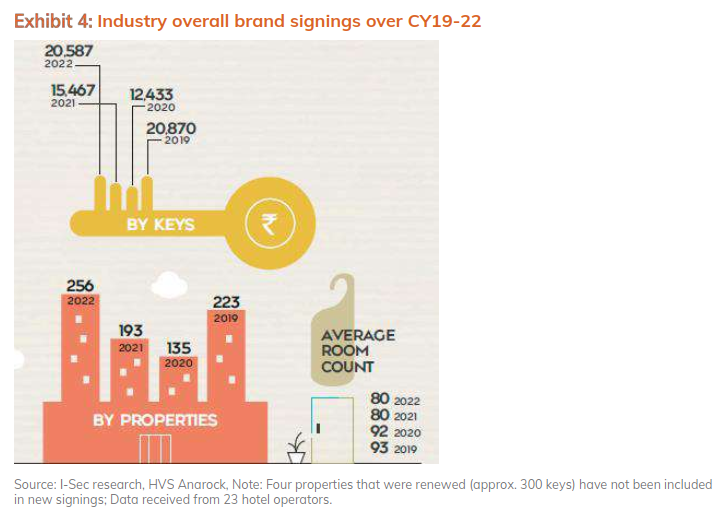

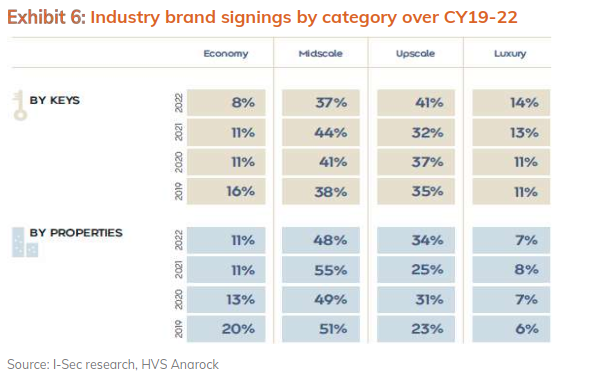

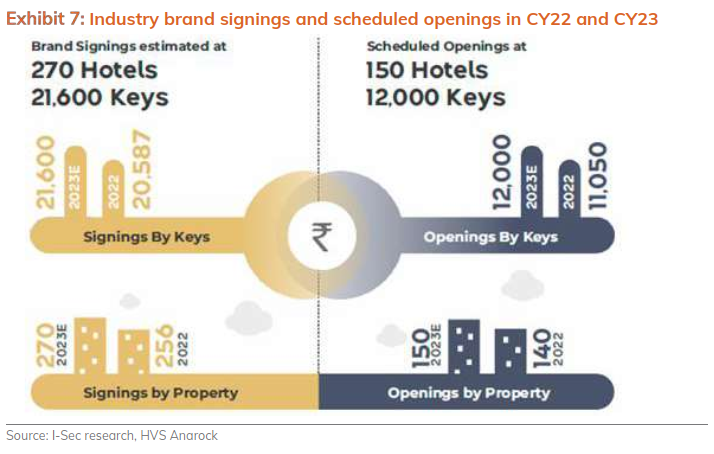

According to HVS Anarock, brand signings increased 33% YoY in CY22: 166 new hotels with 14,885 rooms were signed, while 90 hotels with 5,702 rooms were rebranded. Management contracts continue to account for the majority share of signings in the Indian hotel sector, and in CY22, management contracts accounted for ~80% of the total signings by keys during the year. Hotel re-branding or conversion accounted for 27.7% of keys signed in CY22 vs. 20% in CY21, while 35.8% of the keys signed in CY22 were for green field projects as opposed to 32% in CY21.

Industry RevPARs expected to grow at double-digit CAGR over CY22-CY25E

According to the India Hospitality Industry Overview 2022 by HVS Anarock, industry-level occupancies, which recovered to 60% in CY22, are estimated to reach 66% in CY23, 68% in CY24 and 70% in CY25. At the same time, industry ARR which stood at INR6, 100 in CY22 is estimated to reach INR7, 106 in CY23, INR7,639 in CY24 and INR7,983 in CY25. In RevPAR terms, this implies that compared to CY22 industry RevPAR of INR3,600, RevPAR may rise to INR4,690 in CY23, INR5,194 in CY24 and INR5,588 in CY25 or a 15.8% CAGR in industry RevPAR over CY22-25.

According to various industry estimates, with incremental room supply CAGR expected to range between 5-6% over CY22-26, medium-term demand-supply dynamics remain healthy for the Indian hotel sector.

Brand signings pick up in CY22, management contracts rule the roost

According to the India Hospitality Industry Overview 2022 by HVS Anarock, CY22 brand signings increased 33% YoY: 166 new hotels with 14,885 rooms were signed, while 90 hotels with 5,702 rooms were rebranded.

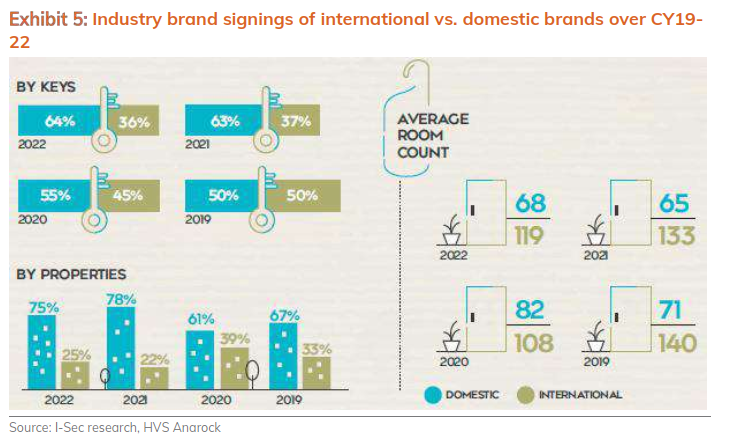

According to the HVS Anarock report, domestic hotel operators signed more properties (75% of the total signings by properties) than their international counterparts, with an average key count of 68 keys during the year. Like domestic chains, international hotel operators have also begun signing smaller properties than they traditionally did, as they continue expanding their footprint in Tier 2, 3 & 4 cities. Consequently, the average number of keys per hotel for international hotel operators decreased from 133 keys in 2021 to 119 keys in 2022.

Management contracts continue to account for the majority share of signings in the Indian hotel sector, and in CY22, management contracts accounted for ~80% of the total signings by keys during the year. Hotel re-branding or conversion accounted for 27.7% of keys signed in CY22 vs. 20% in CY21 while 35.8% of the keys signed in CY22 were for Greenfield projects as opposed to 32% in CY21. As a result, the share of brownfield keys signed declined from 48% in CY21 to 36.5% in CY22.

Read more: Statistics